Financial Strategy Overview

Financial Strategies are essentially user defined 'what-if' scenarios. They allow users to analyse multiple financial approaches and select the best strategy for optimal asset portfolio life-cycle performance (both financial and service potential). Capital treatment, maintenance and operational costs are part of the financial strategies that have a significant effect on the service delivery potential of the asset portfolio.

For example, logical decisions can be made if you have the answers to questions like:

- What will happen to the future service potential of our assets if we spend a million dollars per year in Capital Works and what would happen if we doubled our budgets?

- What would happen if we halved our budgets for the next five years?

- What would happen if we injected one-off temporary capital funding for the next three years?

- How would the maintenance budget be affected by each of these scenarios?

Financial Strategies in Predictor provide the user with a range of options to develop, analyse and refine comprehensive financial scenarios.

Adding a Financial Strategy

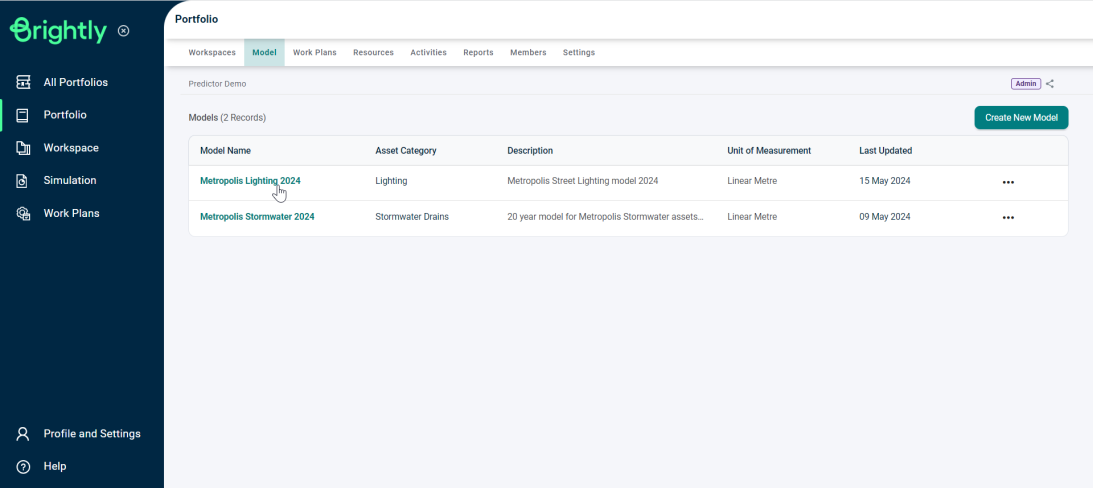

First log into Predictor and open a Portfolio, then click on the Model tab at top to open the list of Models.

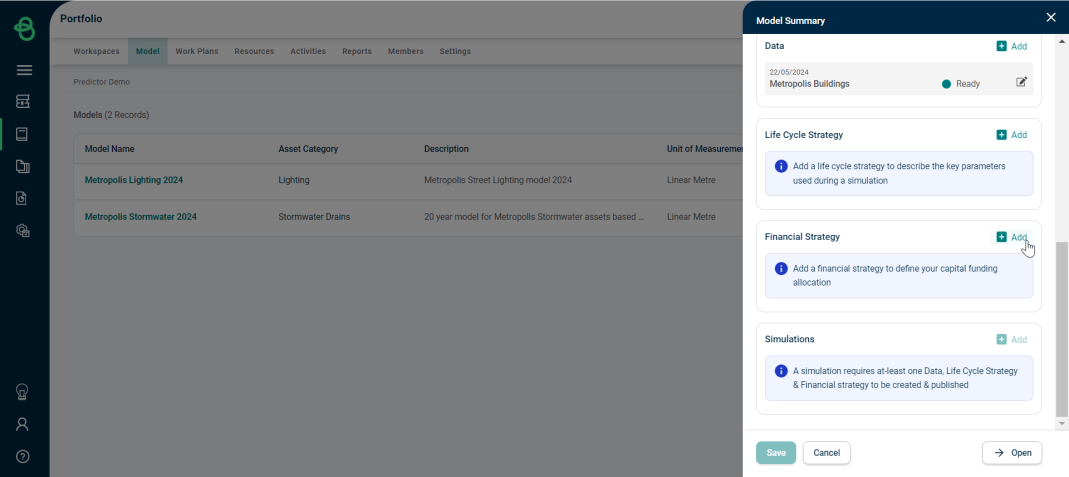

Next, select a Model. This will open a sidebar with the summary of the selected Model. Scroll down and click on 'Add' in the 'Financial Strategy' section.

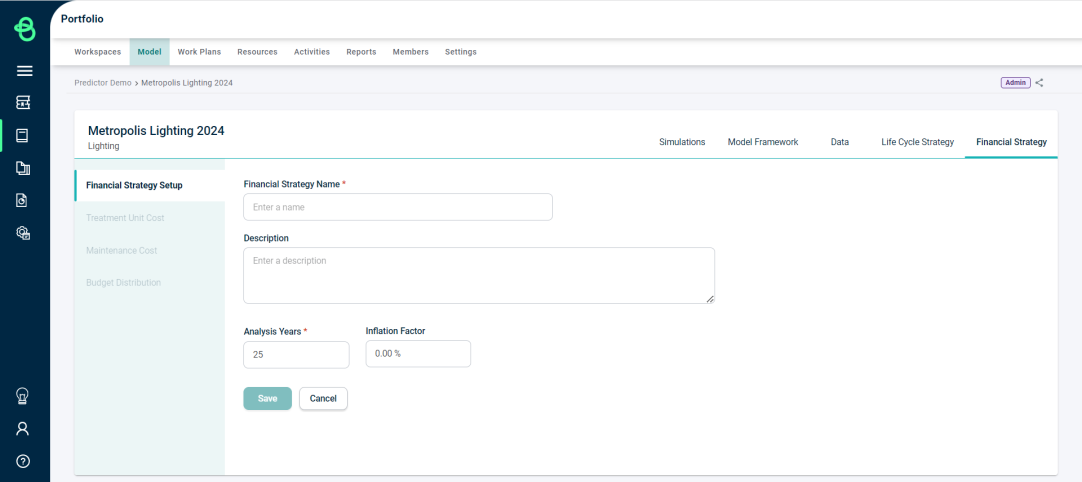

This will open the Financial Strategy Setup page to setup the strategy.

-

Financial Strategy Name: Choose the appropriate name for the Financial Strategy.

-

Description: Choose the appropriate description for the Financial Strategy.

-

Analysis Years: This depends on the specific objectives of an agency's asset management strategies. For example, there may be either a short analysis period of 5 to 10 years, or a long-term network level perspective of the portfolio if modeled for 20 to 30 years. The default is 25 years.

-

Inflation Factor: This defines the rate of increase applied to costs incurred at a future date to reflect the relative purchasing power of money relatively to a particular time, usually the present. Inflation will increase future annual budgets and treatment costs, based on the % value set. The default is 0%.